Green Skills in German Manufacturing

by Oliver Falck and Akash Kaura

- For all its perennial focus on traditional industries, Germany has done a remarkable job in greening its manufacturing

- Green skills are quickly gaining prominence

- Automotive manufacturing is leading the way

Germany is an industrial powerhouse. In 2021, manufacturing accounted for 20.2% of its economy’s gross value added, compared to 19.9% in Poland, 17.0% in Italy, 12.5% in Spain and 10.0% in France.

All the more disturbing then for company bosses and policymakers alike to see the oncoming waves of change sweeping across so many fronts simultaneously. Decarbonization, digitalization, electrification, policy changes, the waning prospects for the hallmark of Germany’s automotive prowess—exquisitely engineered internal combustion engines—and growing competition from China, to name but a few. They all portend wrenching change.

In short, Germany’s industry must adapt, and no better bellwether for how far along Germany is in this transition than its automotive industry.

The reason? It would be hard to overstate the importance of Germany’s automotive industry for its economy. Directly or indirectly, it accounts for around 9% of GDP, employs 2.74 million people, and produces roughly 50% of the European value added in motor vehicle manufacturing.

As in all sectors and industries, the foundation for effective change, far more than new processes or new products, is the acquisition and development of suitable skills among the workforce. And, in this case, the skills called for are of the green sort.

Unfortunately, the level of detail for a more reliable and thorough picture of the overall skills situation in the automotive industry is not available in the official administrative data. The next best way to find out how the skills landscape is greening up would be to check what professionals say about themselves, and the foremost platform for that is LinkedIn.

And, indeed, the data made available by LinkedIn is sufficiently fine-grained to underpin every aspect of the analysis presented in this Policy Insight. The findings gleaned from the LinkedIn data are encouraging, albeit also indicative of the long road that still lies ahead.

As it turns out, Germany’s internal combustion brigade can do electric. Not only that. Despite the country’s resistance to the EU’s plan of phasing out internal combustion engines within a decade or so, the Teutonic automotive machine is in fact propelling the nation’s green transition forward.

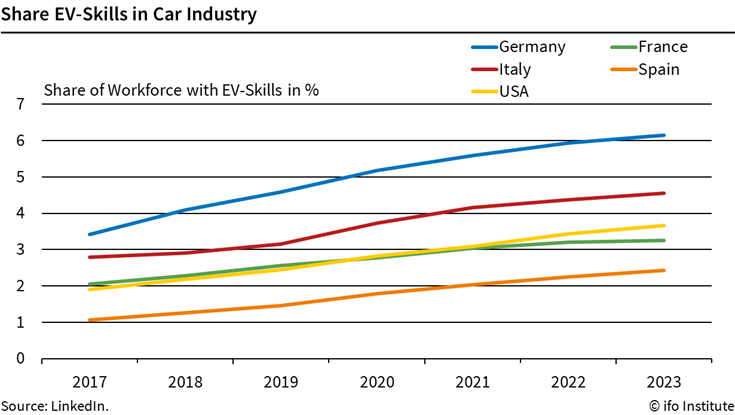

A comparison of the four largest European economies in terms of automotive value added, namely Germany (52.5%), France (9.2%), Spain (6.0%) and Italy (5.9%), plus the USA, shows that Germany’s electromobility skills are well ahead of all the other countries in the sample—and have been rising steadily for the better part of the past decade.

Comparing then the Big Four carmaking Original Equipment Manufacturers—Audi, BMW, Mercedes and Volkswagen—with the US’s electric vehicle (EV) market leader shows that the German OEMs are actually around 1% ahead in terms of the share of workers possessing EV skills.

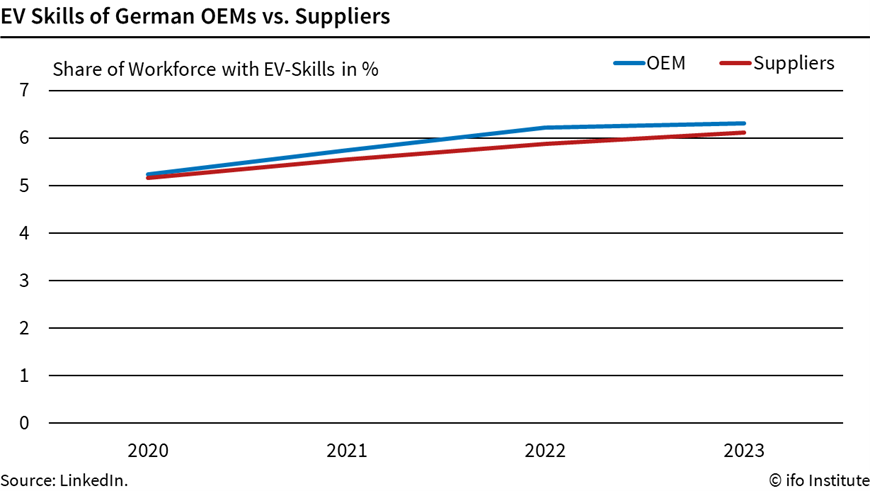

But it is not only the OEMs that are charging ahead: their suppliers too. In terms of EV skills, the data shows no big difference between the OEMs and their Tier-1 suppliers. This is not surprising: these Tier-1 companies are key suppliers to the entire EV manufacturing industry around the globe.

What are the skills in question? When discussing the EV skilled workforce in automotive, we refer specifically to green-tinged skills, i.e., those most closely associated with the electrification push: 'Electric Vehicles', 'Battery Charger', 'Battery Electric Vehicle (BEV)', 'Battery Management Systems', 'Battery Testing', 'Hybrid Electric Vehicles', 'Electric Cars', 'Electric Motors', 'Electric Power', 'Electric Propulsion', 'Electric Transmission', 'Electric Utility', 'Batteries', 'Lithium-ion Batteries', 'Lithium Batteries', 'Nickel', 'Cobalt', 'Lithium', 'Manganese', 'Graphite', 'Automotive Electrical Systems', 'Automotive Design', 'Automotive Engineering', 'Automotive Technology', 'Automotive Electronics', 'Fuel Cells', 'Powertrain', 'Energy Efficiency', 'Charging', 'Environmental Compliance', 'Environmental Policy', 'Energy Policy', 'Smart Grid', 'Electricity Markets', 'Power Systems', 'Power Transmission', 'Power Generation', 'Power Distribution'.

Carmakers hitherto steeped in internal combustion technologies cannot meet all their transition-related green skills needs simply through hiring, as Tesla does it in the US and elsewhere. While hiring has indeed been the German carmakers’ main source of skills acquisition, to truly master the transition they will have to devote time and resources to equipping their long-serving workers with such skills through tailored training.

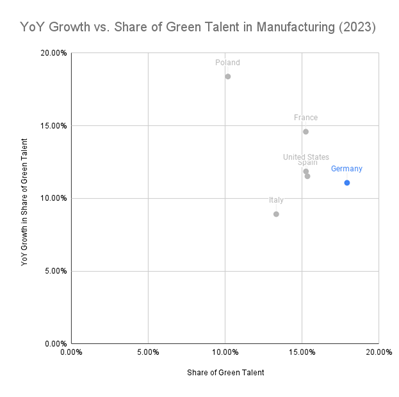

Looking at manufacturing in general in a European-plus-USA context, Germany still leads the way in the share of green talent, with 17.9%, ahead of Spain (15.3%), the United States (15.3%), France (15.2%), Italy (13.3%) and Poland (10.2%). However, the year-on-year growth in the share of green talent still leaves some room for improvement.

In summary, while Germany, both through its automotive industry proxy and in manufacturing in general, scores surprisingly well in the green skills arena, it will need to up the game even more if it wants to ride the disruption wave instead of being swept aside by it.

In any case, the demand for green skills can only go up, drawing wages upwards in the process. Subsidies for the manufacturing of green automotive products, such as EVs and batteries, will further fuel wage increases—and will do nothing to ease the skills shortage.

This adds renewed urgency to devising and implementing the right policies to guide and support the transition towards green manufacturing and greener mobility—and to support the acquisition of green skills.